By Jeffrey D. Fisher, Ph.D.

Although returns for commercial real estate have been somewhat modest this past year, returns for the fourth quarter of 2017 were the highest quarter for the year according to the NCREIF Property Index (NPI). The NPI reflects investment performance for 7,527 commercial properties, totaling $559.8 billion of market value owned and managed by the nation’s largest institutional investors and pension funds.

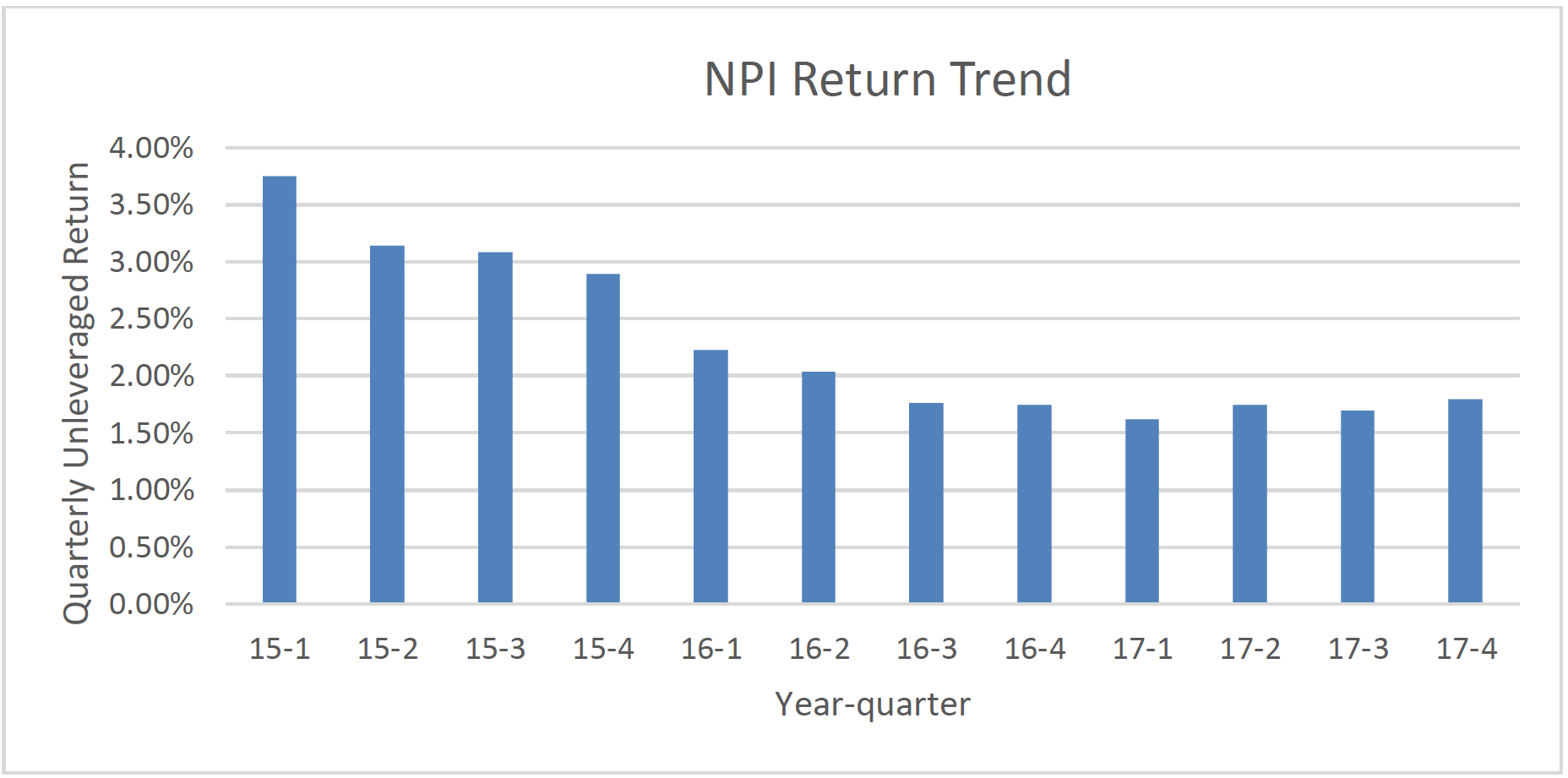

The quarterly total return was 1.80% in the fourth quarter, up from 1.70% last quarter, and higher than the 1.73% return for the fourth quarter of 2016. For the year of 2017, the return was just slightly under 7%. This is an unleveraged return for what is primarily “core” real estate held by institutional investors throughout the US.

The average quarterly return over the past five years was 2.48% or 10.30% annualized. Although the current quarter’s return of 1.80% or 7.40% annualized is down from the torrid pace during the previous 5 years, the downward drop in returns that we witnessed for several years came to a halt this past year with the stabilization of returns.

The fourth quarter 2017 total return consisted of a 1.16% return from income and 0.63% from price appreciation. Over the past four quarters, both components of the total return have been relatively stable. The income return of 1.16% implies an annual cap rate of about 4.64%. Cap rates had been dropping steadily for many years but are no holding steady.

Leverage Continues to be Favorable

The NPI represents unleveraged property performance. However, about half of the properties in the NPI utilize leverage, which can provide an opportunity for higher returns given the low interest rate environment. For the 3,692 NPI properties utilizing leverage, the leveraged total return was 2.28% in the fourth quarter 2017 or an annualized return of 9.44%. Thus, leverage continues to be favorable with the unleveraged return exceeding the interest rate on the properties in the index. For properties that have leverage, the average loan to value ratio is 41% and the average interest rate being paid is just under 4%.

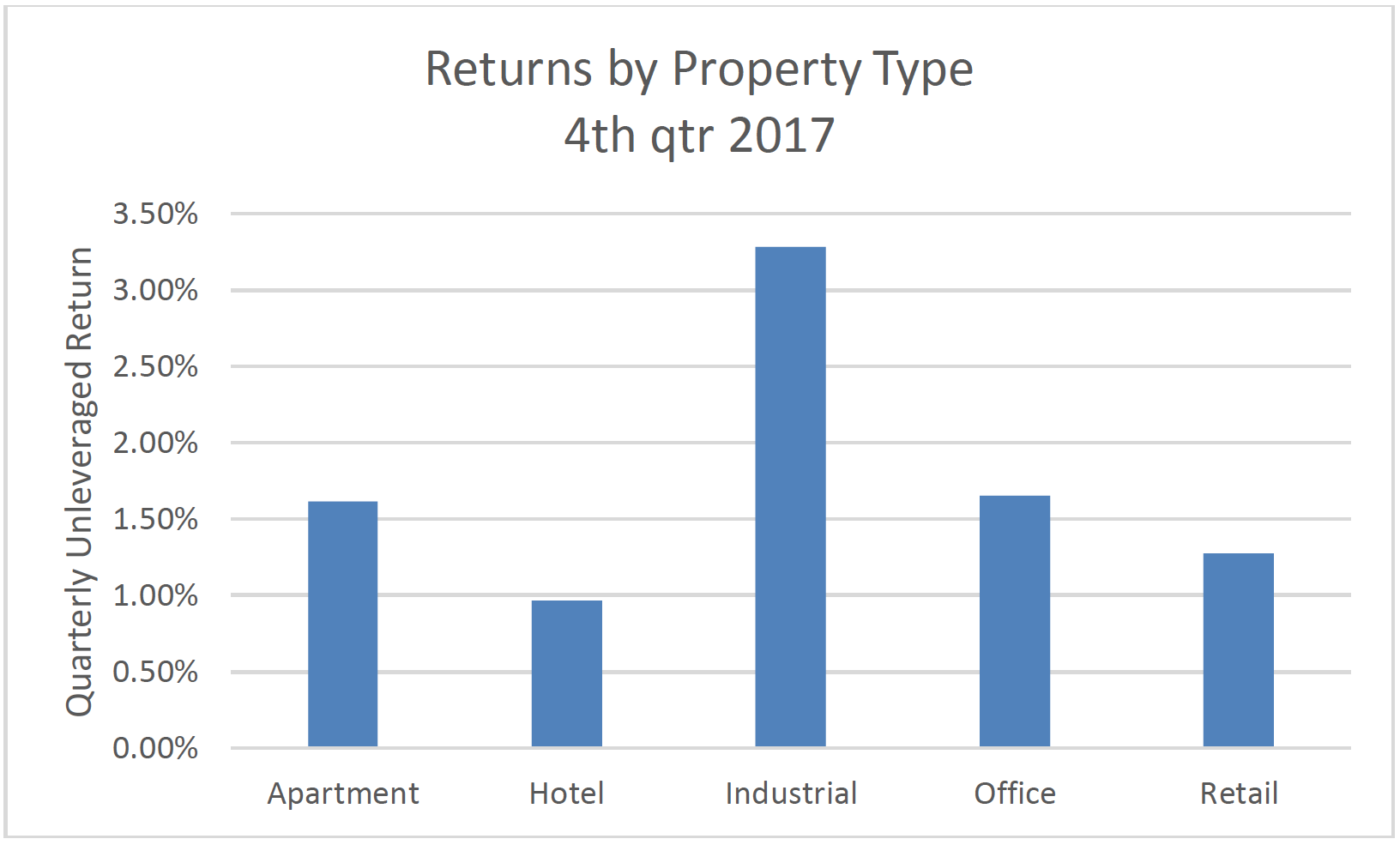

Industrial Returns Leading the Charge

Industrial continues to lead performance by property type with total returns of 3.28% in the fourth quarter or 13.78% on an annualized basis. Other NPI property types trail by a wide margin in the fourth quarter with the hotel total return at 0.96%, apartment at 1.62%, office at 1.65% and retail at 1.27%. The strong return for industrial properties is due to the demand for warehouse space needed for online retailers like Amazon.

NPI Total Returns by Property Type

Fundamentals Strong

Occupancy for NCREIF-tracked properties rose to a 16-year high, at 93.6%. The highest occupancy was for industrial properties at 96.37%, up from 96.10 percent the prior quarter. The second highest was retail at 93.05% which was down just slightly from 93.08% the prior quarter.

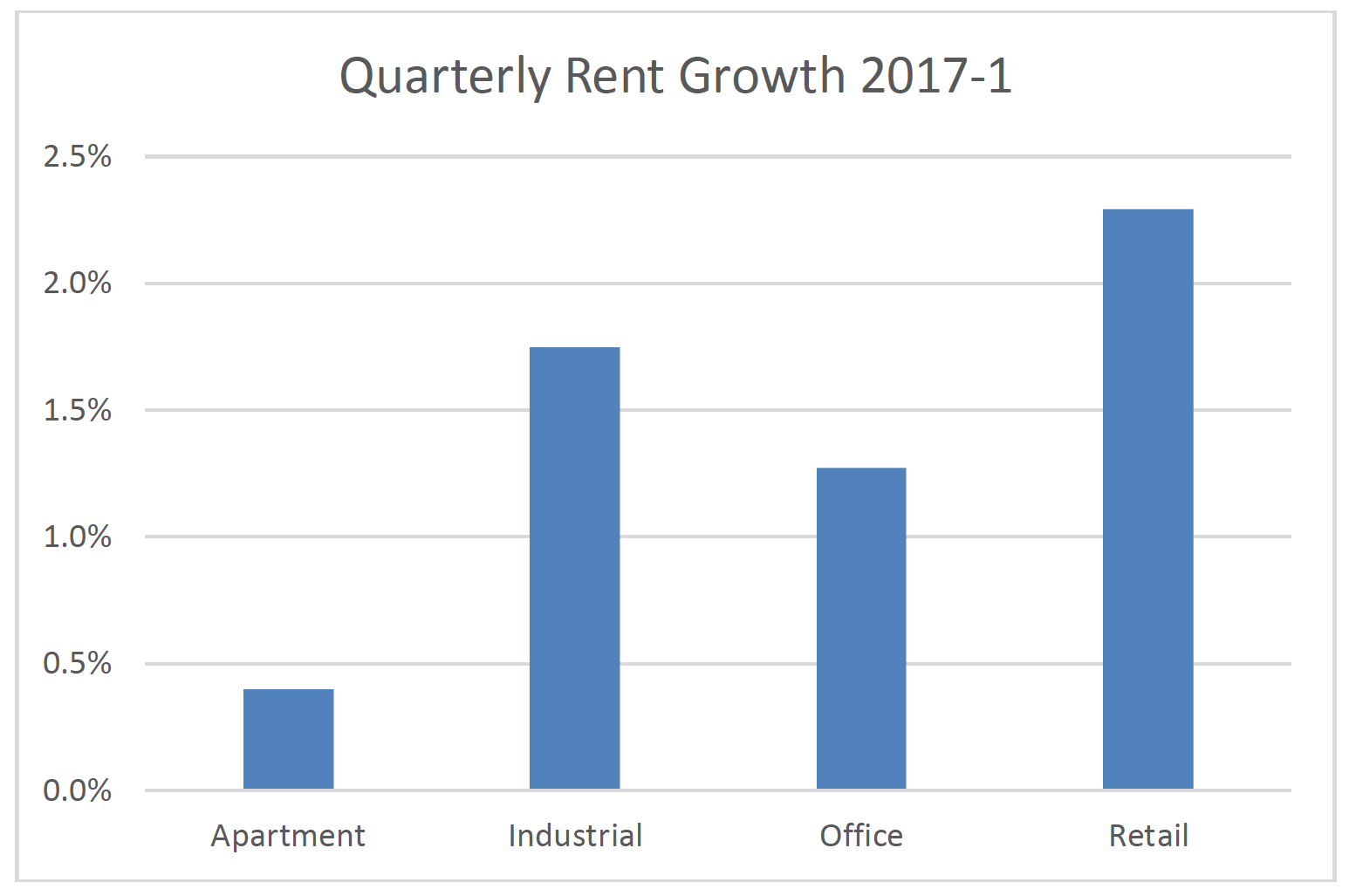

As might be expected, rent growth was high for industrial properties at about 1.75% for the quarter. But this was actually second to retail properties which had about 2.25% rent growth for the quarter. This may be somewhat surprising given all the retail store closings. But institutional investors tend to hold the better retail properties in the nation so perhaps they weren’t impacted as much as might otherwise be expected.

Transaction volume for NPI properties totaled $11.5 billion in the fourth quarter 2017 with 228 properties sold. This continues to be above average transaction activity which has historically been accompanied by a strong market.

While it is too early to be sure, it appears that a combination of tax reform and continued strength in the economy has helped reverse the decline in returns that had been occurring before this year and even resulted in a slight uptick in the fourth quarter.