By Jeffrey D. Fisher, Ph.D.

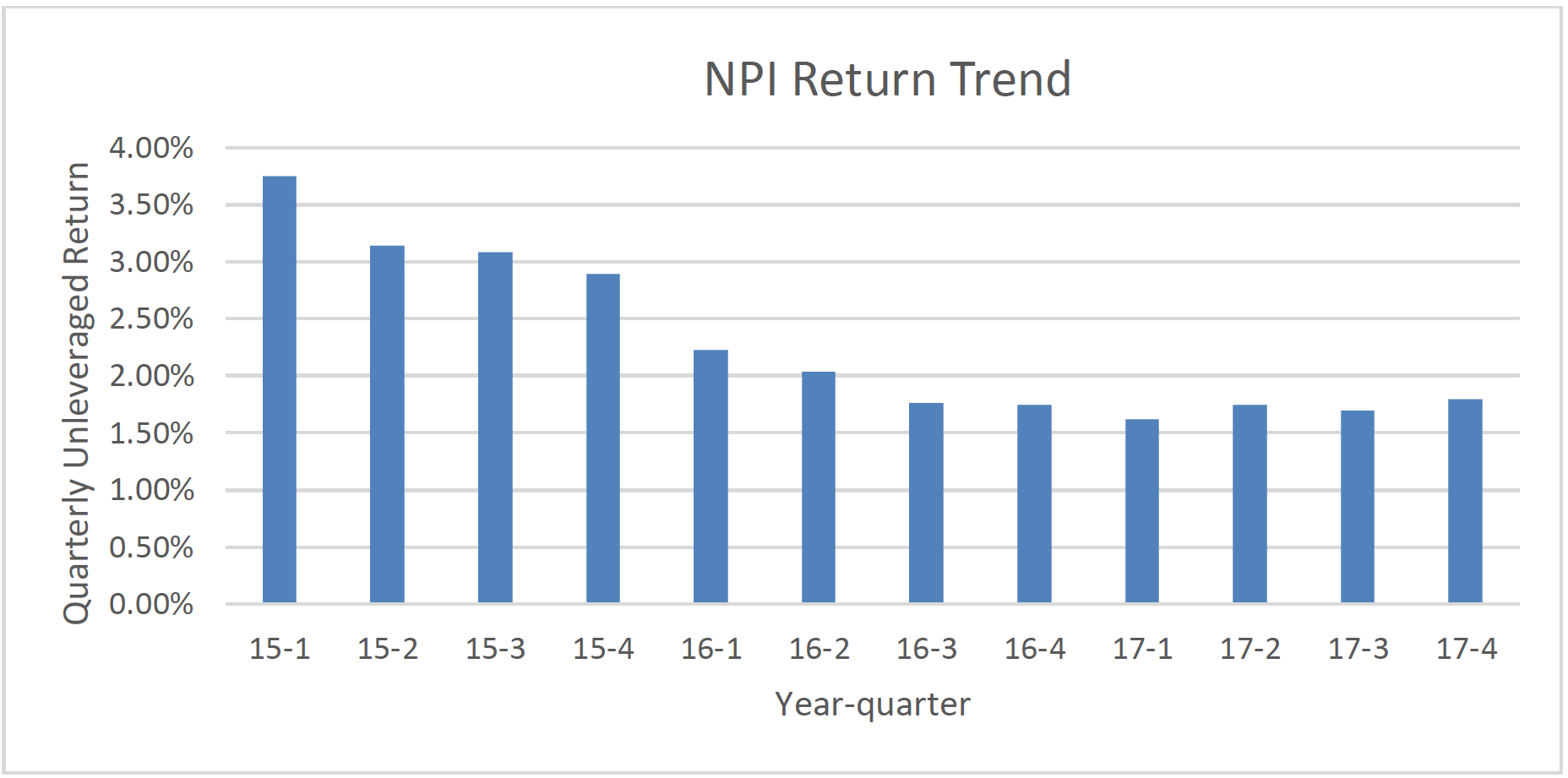

Although returns for commercial real estate have been somewhat modest this past year, returns for the fourth quarter of 2017 were the highest quarter for the year according to the NCREIF Property Index (NPI). The NPI reflects investment performance for 7,527 commercial properties, totaling $559.8 billion of market value owned and managed by the nation’s largest institutional investors and pension funds.

The quarterly total return was 1.80% in the fourth quarter, up from 1.70% last quarter, and higher than the 1.73% return for the fourth quarter of 2016. For the year of 2017, the return was just slightly under 7%. This is an unleveraged return for what is primarily “core” real estate held by institutional investors throughout the US.