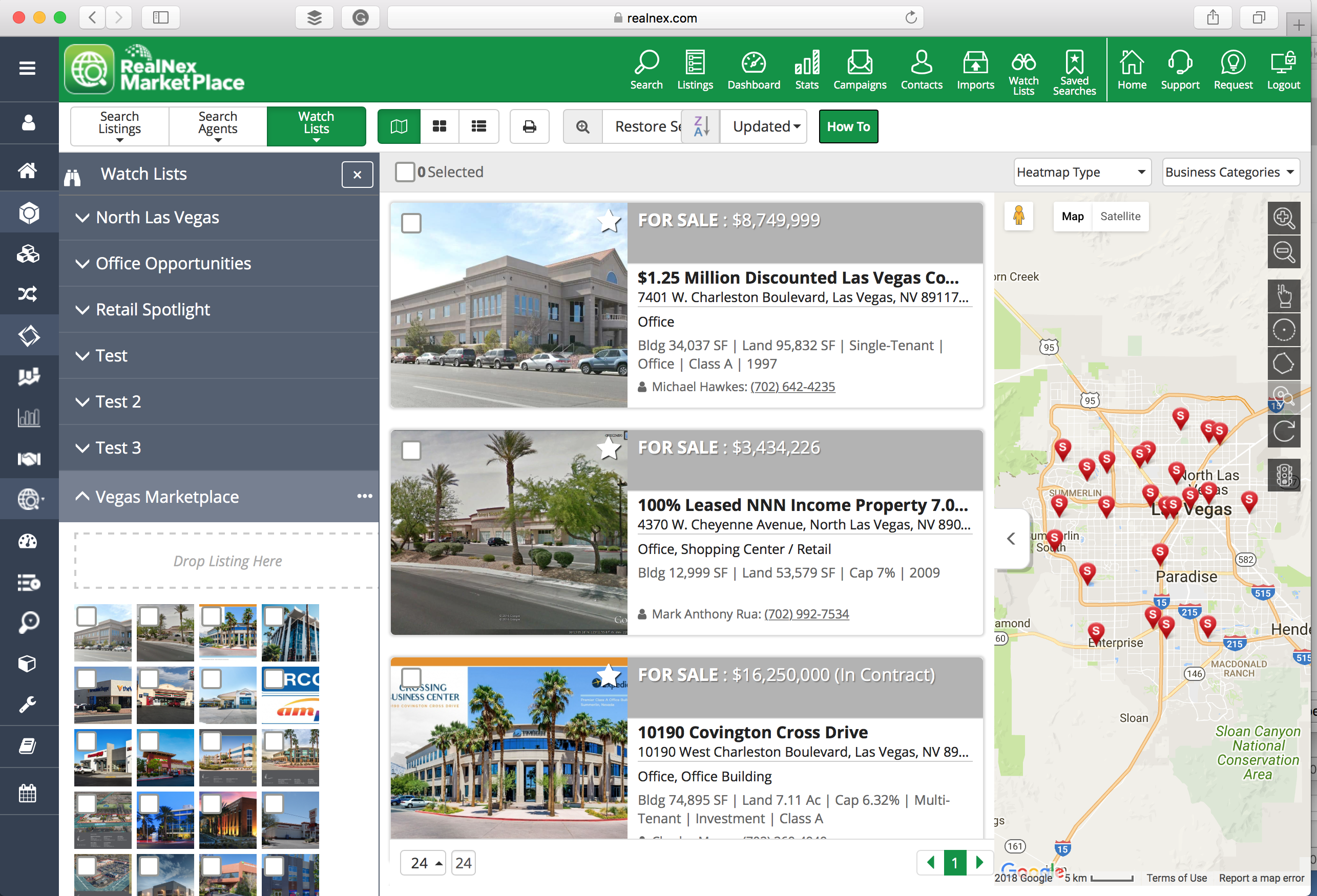

HOUSTON-July 25, 2018-RealNex, a commercial real estate technology company, today announced several advancements to its MarketPlace solution that dramatically improves the user experience. The RealNex MarketPlace is a powerful Listing Management tool for commercial real estate brokers and a dynamic property marketing engine that drives transactional efficiency for buyers, sellers and end-users.

RealNex MarketPlace Enhancements Improve User Experience and System Performance

Topics: RealNex News

Pix, CREtech Partner for Groundbreaking Virtual Reality Survey

All real estate professionals invited to participate in measuring how virtual reality is disrupting real estate.

Topics: RealNex News

RealNex Webinar Series with Dr. Peter Linneman: Where in the cycle are we?

Topics: RealNex Webinar Series

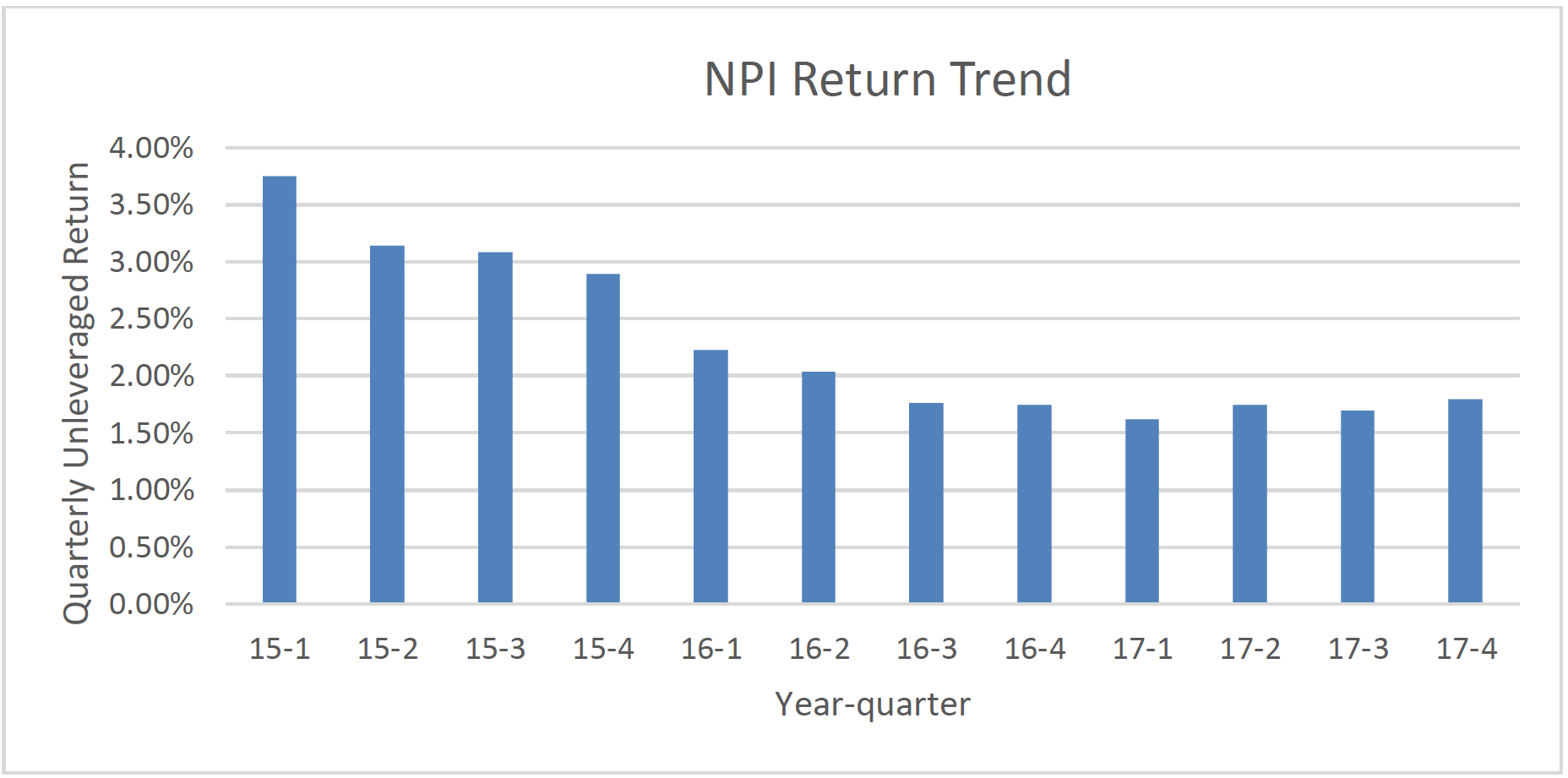

RealNex CEO Jeff Finn hosted head of research Jeffrey Fisher Ph.D. on May 30, 2018 or an informative webinar where Dr. Fisher discussed his recent findings and analysis on behalf of the National Council of Real Estate Investment Fiduciaries (NCREIF). NCREIF polls its members quarterly to create their NCREIF Property Index (NPI). The NPI reflects investment performance for 7,553 commercial properties, totaling $567 billion of market value held by large institutional investors in the US.

Topics: RealNex Webinar Series

CRE Market Update: A Tale of Two Property Sectors, Jeffrey D. Fisher, Ph.D.

Returns for institutional real estate investors remained steady at about a 7% annual return through the first quarter of 2018. The total return was 1.70% in the first quarter, down slightly from 1.80% last quarter, but up slightly from the 1st quarter of 2017 as seen in the chart below. These are the national returns from the NCREIF Property Index (NPI). The NPI reflects investment performance for 7,553 commercial properties, totaling $567 billion of market value held by large institutional investors in the US.

Topics: RealNex Webinar Series

RealNex is stepping things up in the CRM world with the launch of RealNex 3.0. This new release includes new features and integrations between MarketEdge, MarketPlace and CORE CRM. RealNex 3.0 is a single solution that can be used during the entire commercial real estate deal process from inception to the finalized deal. RealNex 3.0 eliminates repetitive data, provides detailed financial analysis and report capabilities, and creates listings with one click that are freely available to the entire commercial real estate market.

Topics: RealNex News

Introducing: Dr. Jeff Fisher Pricing Webinar

Dr. Jeff Fisher is a founding partner of Pavonis Group and Head of Research of RealNex. He is also President and Chairman of the Board of the Homer Hoyt Institute and Professor Emeritus of Real Estate at the Indiana University Kelley School of Business.

Topics: RealNex Webinar Series

Commercial Real Estate Returns End Year on Upbeat

By Jeffrey D. Fisher, Ph.D.

Although returns for commercial real estate have been somewhat modest this past year, returns for the fourth quarter of 2017 were the highest quarter for the year according to the NCREIF Property Index (NPI). The NPI reflects investment performance for 7,527 commercial properties, totaling $559.8 billion of market value owned and managed by the nation’s largest institutional investors and pension funds.

The quarterly total return was 1.80% in the fourth quarter, up from 1.70% last quarter, and higher than the 1.73% return for the fourth quarter of 2016. For the year of 2017, the return was just slightly under 7%. This is an unleveraged return for what is primarily “core” real estate held by institutional investors throughout the US.

Topics: RealNex Webinar Series, RealNex News

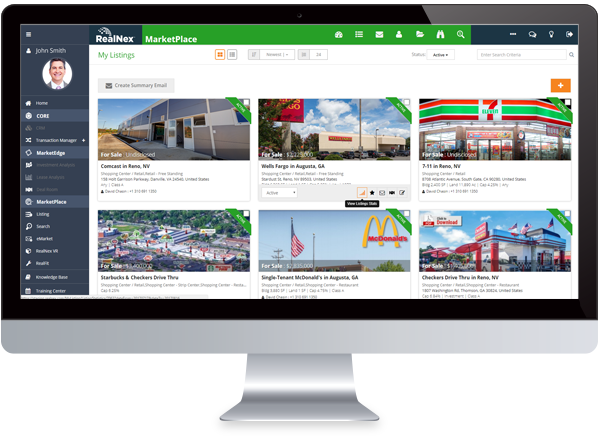

RealNex releases new MarketPlace - Public Commercial Property Portal Builds upon PropertyLine and Buzz Target Legacy

HOUSTON-January 9, 2018-RealNex, a commercial real estate technology company, today announced the launch of its all new MarketPlace. The new public portal offers a free alternative to list and search a growing nationwide portfolio of property offerings. Built upon the 25-year legacy of PropertyLine and the innovative technology of Buzz Target, the MarketPlace launches with 250,000 listings across North America, totaling $450 billion for sale and 4.7 billion sf for lease.

Topics: RealNex News