The Evolution of a Year: Navigating Real Estate Changes

What a difference a year makes. When we unveiled our findings last year in a session titled "Back to Normal," we were riding the wave of a year that had yielded over 20% returns. Even in the face of rising interest rates, cap rates held at record lows. Just twelve months later, we've experienced a rapid shift from the peak. Over the course of three quarters, property values have declined, cap rates have risen by 50 basis points, capital raising has become challenging, and transaction volume has plummeted. Where do we go from here?

Dr. Jeffrey Fisher, Head of Data and Research at RealNex, shared his insights during the RealNex webinar on August 17, 2023, drawing from his work with institutional real estate investors at NCREIF.

Institutional investors remain cautiously pessimistic, expressing belief that the Federal Reserve has yet to complete its cycle of interest rate increases. They anticipate the long-term 10-year Treasury to be priced at 4.5%, with a 2-point spread over the expected inflation rate of 2.5%—a slight increase from current rates. The inverted yield curve, historically indicating an impending recession, adds to their concerns, although they maintain hope for a "soft landing."

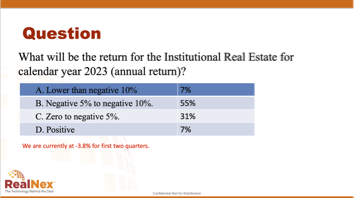

Credit conditions, nearly as tight as those experienced during the Global Financial Crisis of 2009-2010, improved slightly in Q2 2023, though they remain worse than during the Covid period. Amidst this tightening, property values have dipped by approximately 10%, and transaction volume has seen a staggering decline of around 60%. This downturn has been driven by the capital markets, as property-level NOI remains positive while cap rates have surged from 3.75% to 4.25%.

A prominent concern looming over the industry is the impending wave of loan maturities, arriving in a climate of reduced property values, heightened interest rates, and stricter lending standards. Counteracting the challenges posed by this debt overhang is a market flush with capital, backed by a history of V-shaped recoveries following market sell-offs. Historical trends indicate that investors don't necessarily need to predict the exact market bottom; they can fare well by entering the market around two quarters before or after that point. With the current down-cycle having progressed for three quarters, it suggests we are approaching the two-quarter window before the bottom, signifying an opportune time to explore market entry points. This view is reinforced by the NAREIT Index, historically a leading indicator, which turned positive in Q2. Furthermore, a study of write-ups and write-downs reveals that even during the peak-to-trough of the Global Financial Crisis, this cycle spanned six quarters. Considering that we are currently five quarters into a write-down cycle, the shift may be in motion.

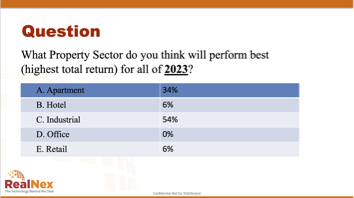

Turning to fresh investment prospects, a notable shift in institutional buyer preferences is evident. In the 1980s and 1990s, Office and Retail properties held the spotlight, constituting around 85% of portfolios. However, there has been an increasing diversification into specialty classes, with Apartments and Industrial (warehouses) commanding approximately 30% each of the market.

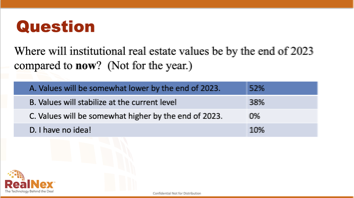

Polls conducted among the audience reflected a level of optimism, suggesting that while the market hasn't hit rock bottom, the worst might be in the rearview mirror.

Dr. Fisher summarized the findings as follows:

- Returns have been negative for a third consecutive quarter.

- Market values have declined for a fourth consecutive quarter.

- Only Hotels have shown positive returns.

- The Office sector has been a significant drag on returns.

- Growth in rents and NOI is showing signs of deterioration.

- The percentage of leased space has experienced a slight decrease.

- Cap rates are on a continuous rise.

- Five properties in the NPI have been returned to lenders.

- 47 properties now have a value equal to or lower than the loan balance.

Feel free to access the presentation deck and the session replay via the provided links. We welcome your thoughts and insights in the comment section below.