There never seems to be a shortage of prognostications about what will happen the moment a crisis hits. Some of you may remember the dire predictions for real estate at the onset of the Global Financial Crisis (housing oversupply for 25 years). A few of you may even remember the doom and gloom from the S&L crisis. Predictably, an immediate conclusion some in the real estate industry reached was that the office market is dead due to Covid-19 – not to return. No ifs, ands or buts. We have proven technology that accommodate us working remotely and we have no need to commute to an office anymore!

The pendulum swings hard and fast in these circumstances, especially with the fervor and confidence with which certain opinions are put forth. Once a few more pile on, the echo can be deafening. However, if you pay close attention, you might detect some conflicting information. Maybe you missed the article suggesting major contractions of office space as owners compete with their tenants due to a flood of activity in the sublet market. That was within days of the article about Microsoft’s major expansions adding 1,500 jobs. Want more? CBRE is dialing back its Hana co-working initiative, but commercial real estate’s survival will be based on WeWork’s model.

Even a single source can be confusing. A recent survey by Integra Realty Resources found that 75% of property managers interviewed are reporting delinquencies. Conversely, only 18% of owners from that survey are seeing an unusually high delinquency rate. But wait, nearly 46% see some, but manageable tenancy issues while approximately two-thirds are focused on occupancy management. Hmm.

We have also discovered that not everyone is properly set up, or well-suited to work from home. Just search “twitter work from home video call fails” or simply click here and you will get the gist. There are also the practical realities to consider. A recent op-ed in the NY Times laments the end of working in offices, removing the last divide between work and home. However, in doing so it also points out the impracticality of that outcome.

There is a reason we have congregated to work for centuries. It is beneficial from a productivity as well as a social perspective. There is also the reality of all the space currently under lease and the inevitable impact upon the owners, tenants and lenders any disruption may cause.

Where does the truth lie? Probably somewhere in the middle, as usual, and there are predictions for that as well. Since we are in a data-driven industry, maybe data can help. While the numbers vary depending on the source, it is generally agreed that the amount of office space per employee has been declining steadily over the past few decades, from between 250 and 300 square feet to between 150 and 200 square feet. A fairly exhaustive analysison this topic was completed by Norm Miller, Ph.D. (University of San Diego) in 2012.

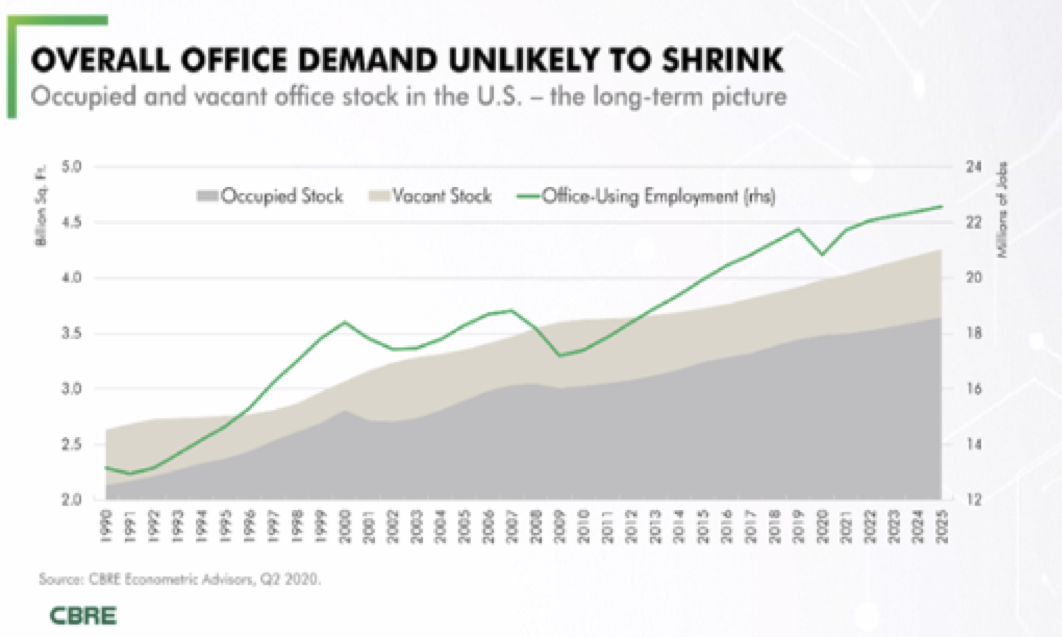

Recently, Richard Barkham, Ph.D, Global Head of Research for CBRE Econometrics presented data to support his conclusion that the impact of recent events on office demand will not be as extreme as many were originally predicting. It also shows that space per employee has not changed much over the past 30 years.

From the chart above we can calculate that on average in 1990 a worker occupied approximately 170 square feet of space. The number has declined to approximately 167 square feet. It is projected to be at 160 square feet by 2025.

So, where does that leave us? For one thing, we still need better data. It seems probable that there will be an occupancy reduction in the near term due to some companies extending work-from-home arrangements and others going out of business and vacating. This dynamic will result in lease restructurings, sub-leasing or new leasing. RealNex’ recently released MarketEdge Lease Tools update is designed to make it easy to handle all of these situations. It also seems probable that many will begin to spend at least some time in the office, but with new layouts to accommodate social distancing recommendations. RealNex VR RealFit is the ideal 3D solution to help landlords and tenants quickly plan the optimal new use of space and see it instantly.

Assuming there is still a perceived benefit for companies to have workers in the same location at least periodically, the initial dire predictions for the office market will turn out to be overstated. Likely there will be a rotation of employees in an office rather than concurrently in order to maintain safe distances. There will also be a reduction in density in order to enable those who are in the office to have the space needed. To find out more about how RealNex can assist with your leasing needs and decision making, click here. To find out more about how RealNex VR powered by Pix can help you design your space, click here.