By Jeffrey D. Fisher, Ph.D.

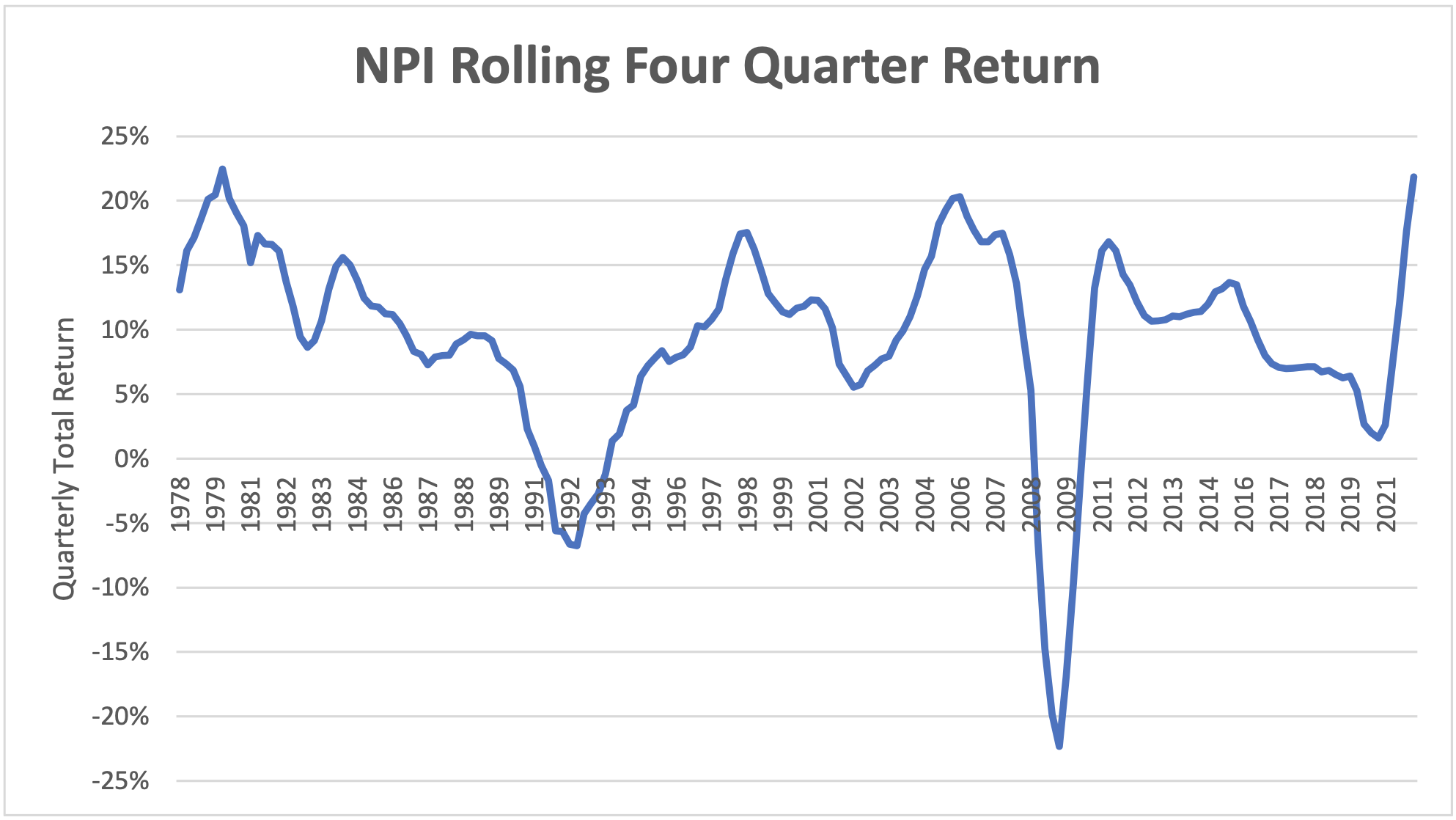

The National Council of Real Estate Investment Fiduciaries (www.NCREIF.org) tracks the performance of over 10,000 investment-grade, income-producing properties with a market value of $897 billion. The properties are held in funds that are managed by investment management firms on behalf of their investors. The market value breakdown by property type is about 28% office, 27% apartment, 15% retail, 30% industrial and less than 1% hotel properties. The NPI includes property data covering over 100 CBSAs. The quarterly total return for the NPI was 5.33%% for the first quarter of 2022 and the rolling annual return for the past four quarters was 21.86% which is the highest since the first quarter of 1980 and the second highest in the 44-year history of the NPI.

Rolling Four Quarter Unleveraged NPI Returns

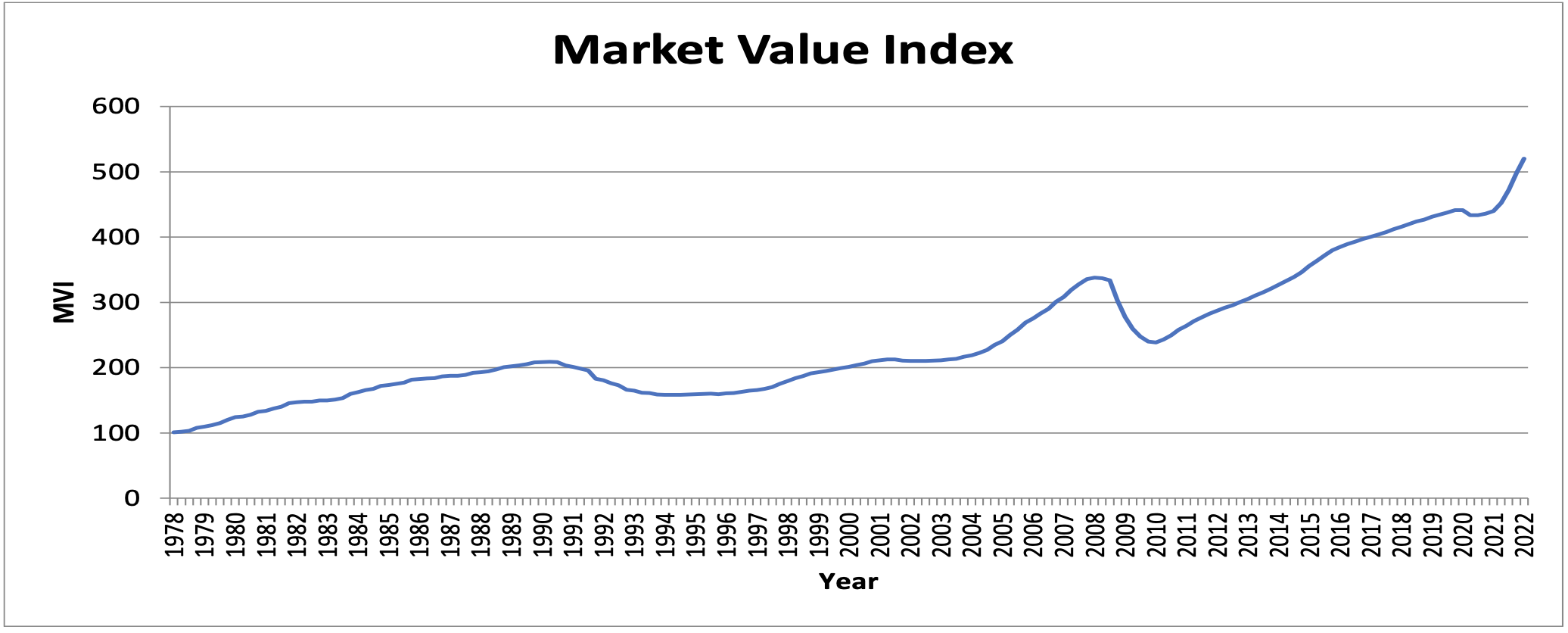

The market values of the properties in the index increased by 4.49%. These values mainly reflect quarterly appraised values although they include the impact of any properties that are sold.

NCREIF Market Value Index

The 5.33% return is the unleveraged returns for what is primarily “core” real estate held by institutional investors throughout the U.S. Properties with debt financing had a leveraged total quarterly return of 6.59%. As of quarter-end there were 4,374 properties with leverage and the weighted average loan to value ratio was 43%.

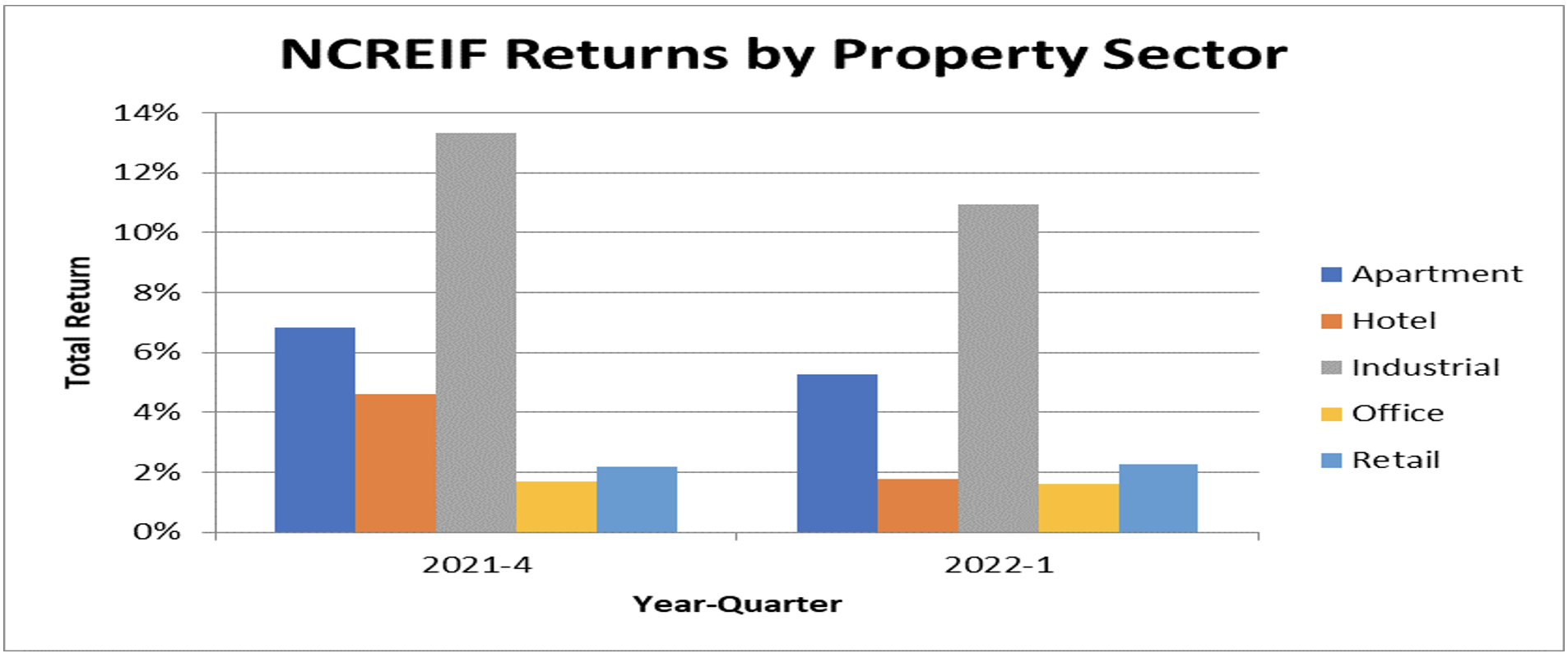

Industrial Sector Continues to Propel Entire Index

The story continues to be the exceptionally strong performance of the industrial (primarily warehouse) sector. The total return for the first quarter was 10.96% which was down from 13.34% the prior quarter but still the highest of any property sector. Apartment properties had the second highest return at 5.25%. Surprisingly, the third best performance was from retail properties with a first quarter return of 2.26%. Hotel and office returns were 1.76% and 1.60% respectively for the first quarter.

Unleveraged Total Returns by Property Sector

Capitalization Rates

Market value weighted capitalization rates dropped from 3.83% during the fourth quarter to 3.71% for the first quarter of 2022 despite rising interest rates. This suggests that for the portfolio of NCREIF properties, investors are willing to buy at a 3.71% current yield. This would translate to a price-earnings ratio of 26.95 and suggests that investors expect some growth in the price of institutional grade commercial real estate. The average market value weighted cap rate over the history of the NPI is 6.59% which implies a PE ratio of 15.18. The PE ratio for the S&P 500 as of April 25th is 21.33 compared to the end of quarter NPI PE of 26.95.

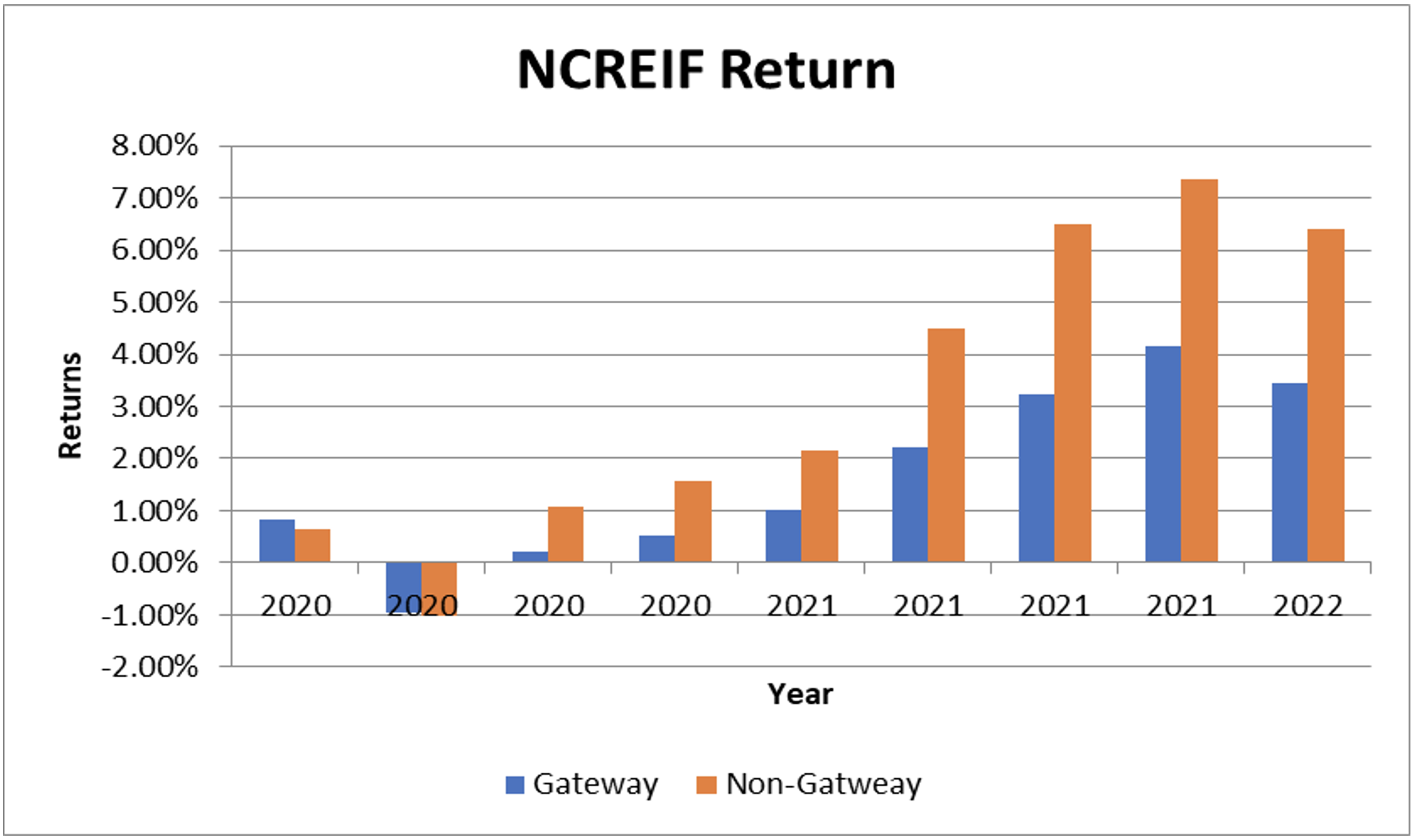

Non-Gateway Markets Outperform

Perhaps due to COVID and more ability to work at home, the non-gateway cities have been performing better than gateway cities (New York, Boston, Chicago, LA, San Francisco, and DC). Although returns for both were down the 1st quarter of 2022, the spread between the two remains about the same.

Conclusion

While returns were off the record highs in the 4th quarter of 2021, the 1st quarter returns were still well above the average over the history of the NPI. Despite higher interest rates, capitalization rates continued to fall which contributed to the higher returns. It remains to be seen whether real estate will continue to be an inflation hedge as it has been historically with cap rates at least holding steady as interest rates increase.