By Jeffrey D. Fisher, Ph.D.

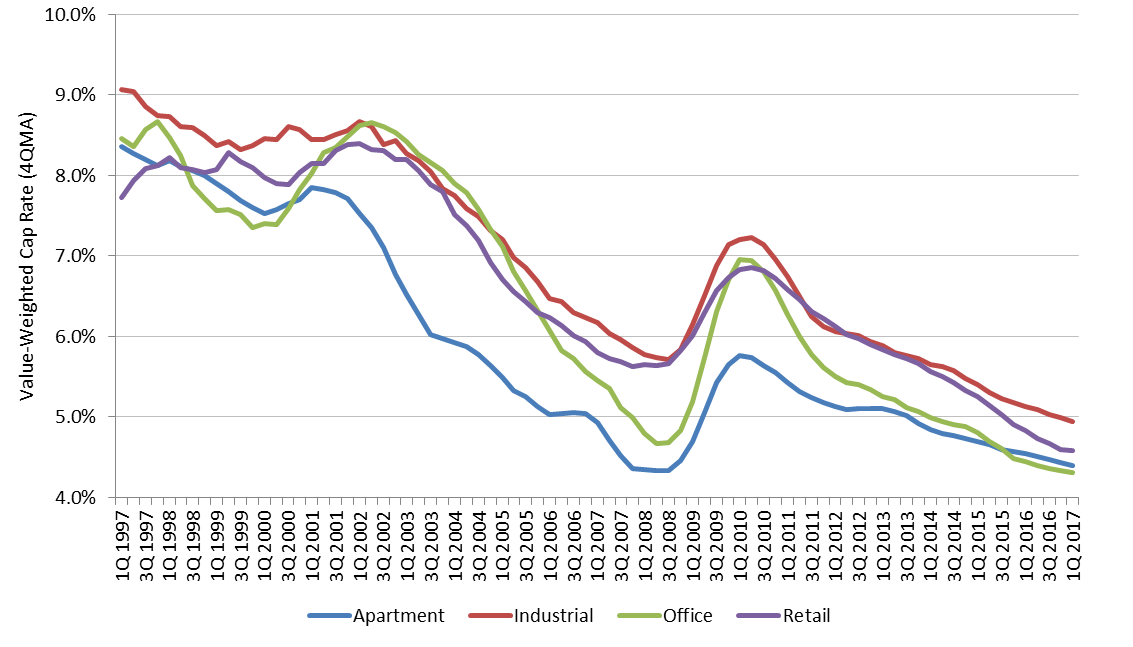

In the RealNex Q2 2022 Commercial Real Estate Market Update, Dr. Jeffrey Fisher, RealNex Head of Data and Research, presented findings on the state of pricing and investment activity in light of high inflation and rising interest rates. Entitled “Back to Normal”, commercial real estate markets continued to perform above long-term trend although showing signs of an inflection point.