By Jeffrey D. Fisher, Ph.D.

In the RealNex Q2 2022 Commercial Real Estate Market Update, Dr. Jeffrey Fisher, RealNex Head of Data and Research, presented findings on the state of pricing and investment activity in light of high inflation and rising interest rates. Entitled “Back to Normal”, commercial real estate markets continued to perform above long-term trend although showing signs of an inflection point.

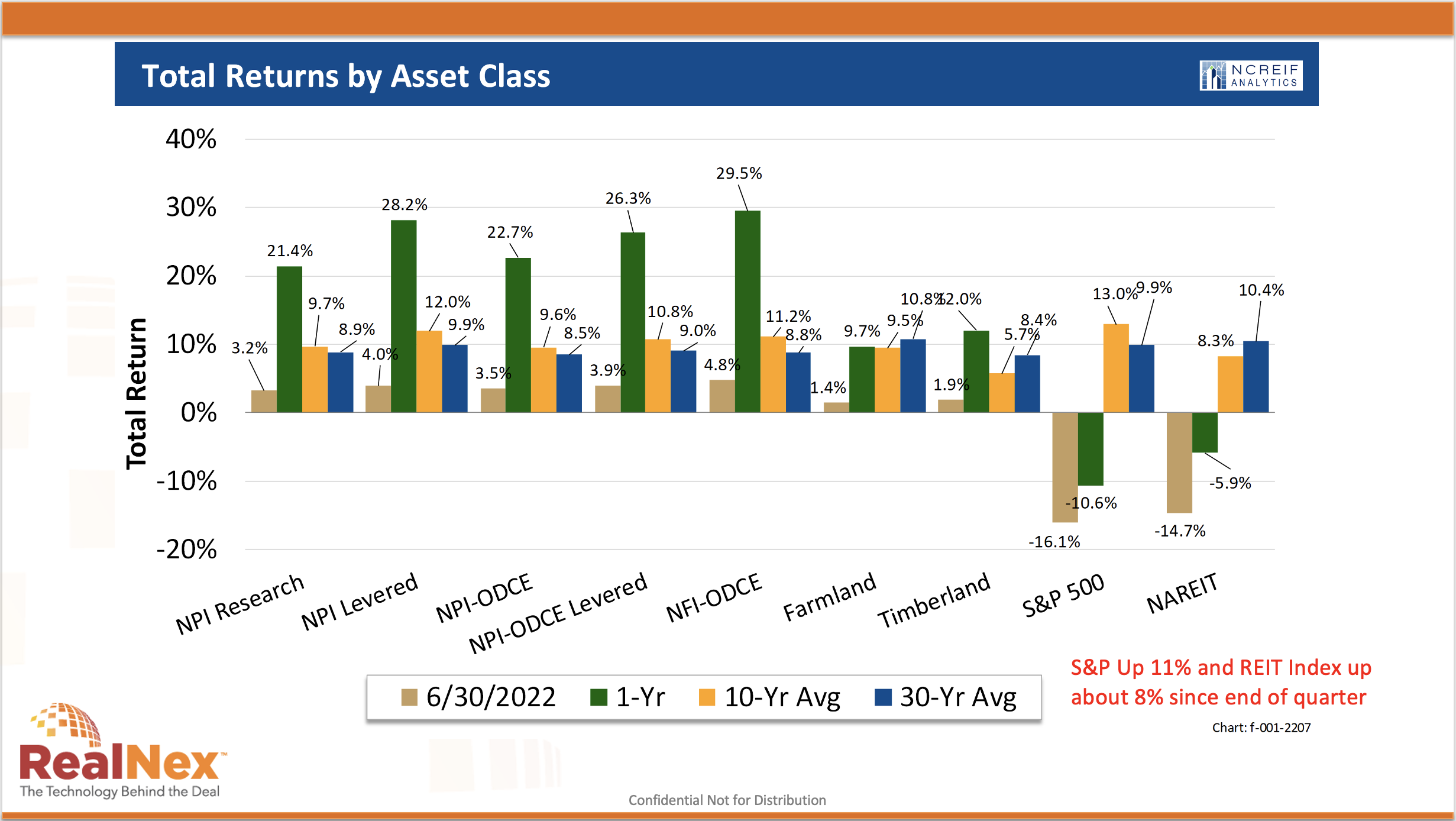

While interest rates rose dramatically throughout the first half of the year, cap rates remain near historic lows. And, with NOI up and expenses down, market values hit new record highs based on the National Associate of Commercial Real Estate Investment Fiduciaries (NCREIF) institutional asset portfolio analyzed by Dr. Fisher. Although the 12-month unlevered return of 21.4% was far above the 10-year average of 9.7%, the quarterly return had dropped to 3%, moving back towards the long-term trend of 2.25%.

The expectation is for markets to continue to move towards but continue to perform above trend, with occupancy improving, rents growing and a record level of “Dry Powder” on the sidelines waiting to be deployed. There is more than $350 billion of institutional Dry Powder committed to Funds seeking institutional quality real estate. This is a strong 40% of the typical annual allocation to this investment class according to CBRE.

A few noteworthy changes in the market highlighted by Dr. Fisher included:

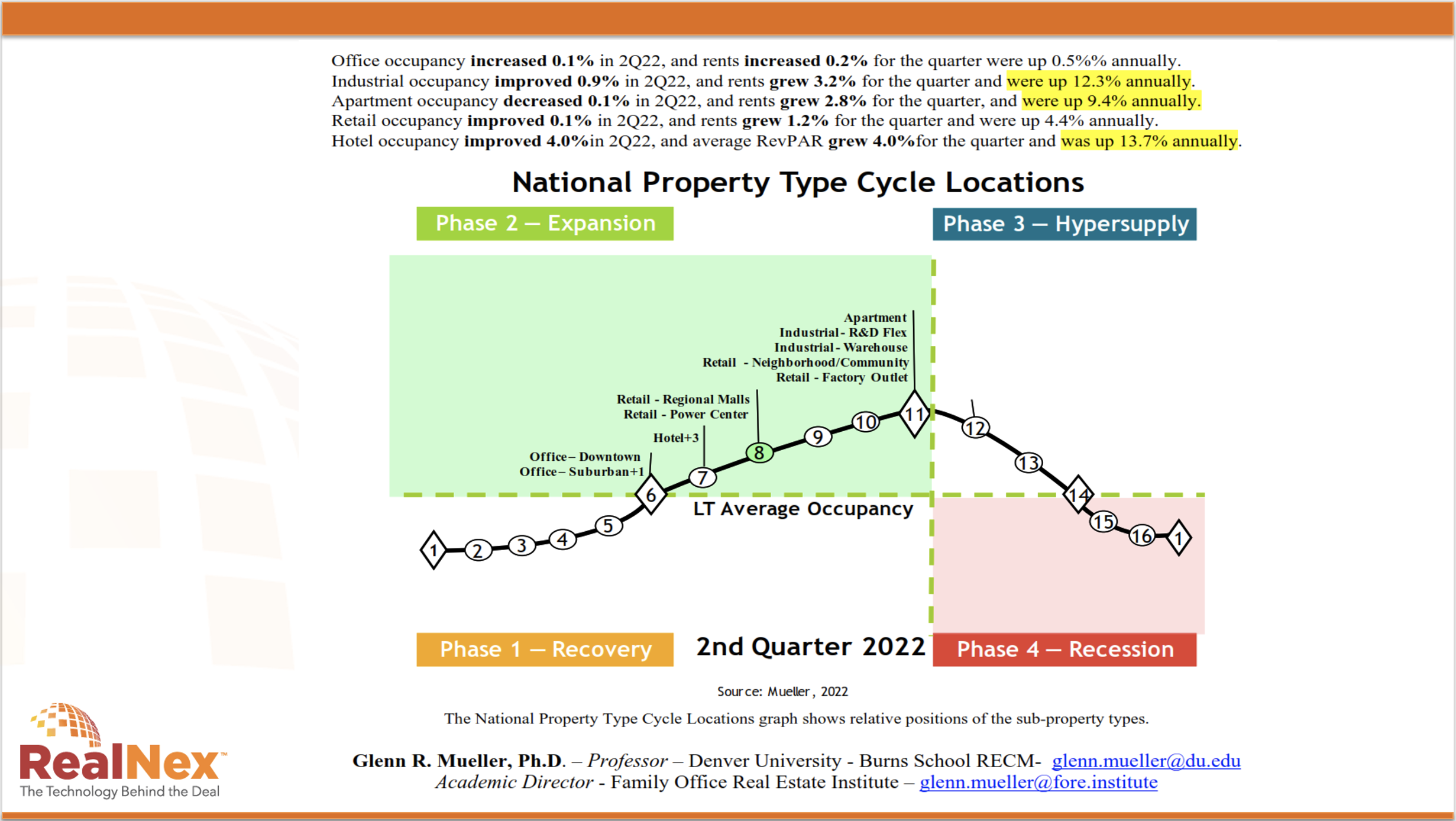

- Apartment rents continued to rise at a 5.7% annual rate

- Institutional investors have moved away from Office as their primary asset allocation

- Office and Apartments are now tied for second most owned asset class at 27% each

- Industrial continues to far out-perform and has become the largest percentage of portfolios at 31%

- Hotel rates and occupancy are on the rise

- Lifestyle and high-quality Retail are in high demand

Dr. Fisher also shared an analysis of Real Estate Market Values in "Real" terms, after factoring for inflation. His Real Value Index of 113, against the 1978 benchmark of 100, indicated that commercial real estate has been a solid hedge against inflation over the long term and while the value gained only modestly in Real terms, the assets generated meaningful yields and cash returns along the way.

Further supporting the thesis for continued strength in CRE Markets, Dr. Glenn Mueller, Denver University-Burns School RECM professor, in his most recent Market Cycle Report, pegged all property types in the Expansion Phase. The report positioned Office just above the recovery line with Apartments and Industrial near the gate to move into Hypersupply.

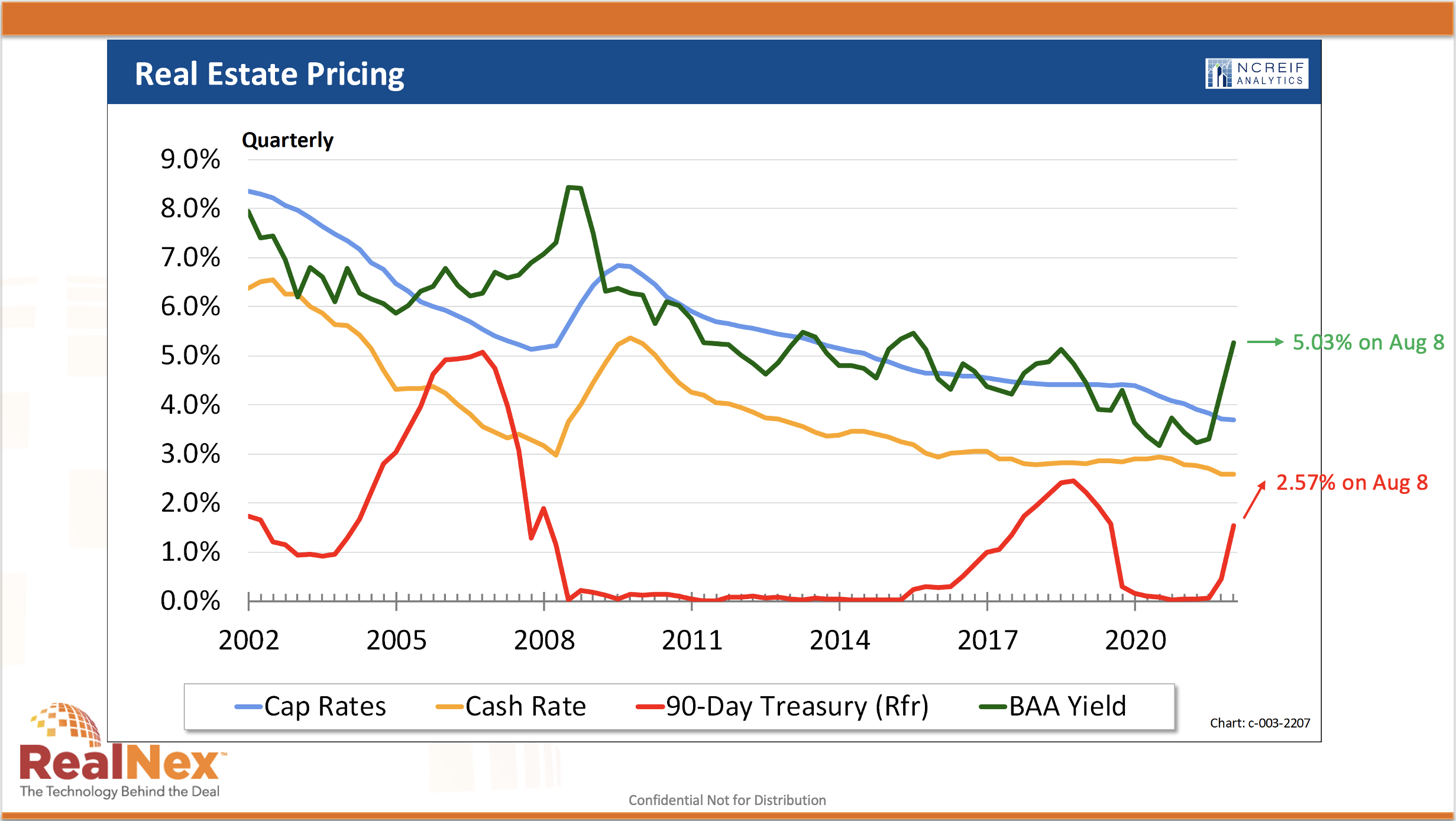

Of concern was the outlook for Cap Rates. Historically, Cap Rates have been highly correlated with the BAA bond rate. While BAA bond rates have spiked, cap rates have yet to follow. Indeed, overall cap rates remained relatively flat at their lowest recorded levels. Industrial cap rates have dropped to below 3.5% and apartments ticked up to slightly above that level. At 4.8% Retail cap rates were at the high-end of the range, with Office holding steady at 4.3%

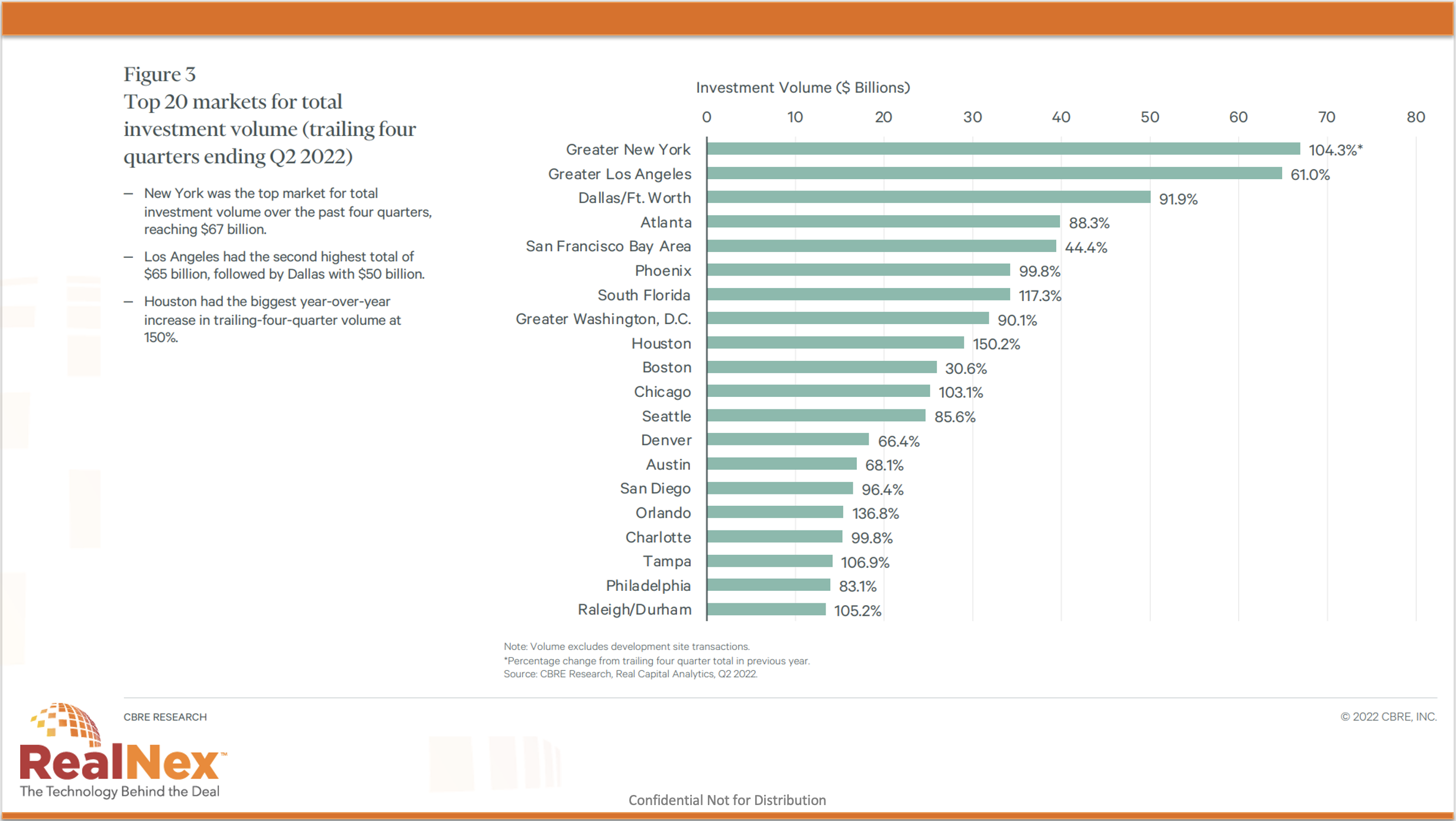

Recovering from the Covid-19 deterioration of investment activity, according to Real Capital Analytics and CBRE, 7 of the largest markets realized more than a 100% increase in investment activity year-over-over:

Interestingly 3 of the strongest increases were in Florida and the top 5 were in the sunbelt.

When polled, 38% the webinar audience believed that Values would be flat and 41% thought values would decline by year-end, with a small 14% thinking values would continue to increase. From an asset class perspective 59% thought Apartments would perform best, 19% supported Industrial, while 11% voted for both Retail and Hotel. None believed Office would be the top performer. Finally, when asked about the impact of inflation and interest rates 62% felt cap rates would rise, 8% saw a further drop and 27% believed we would remain flat through year-end.

Summarizing the landscape Dr. Fisher noted,

- Returns Down past two quarters but still above long-term average

- Price levels (Market Value Index) at new high

- Returns down for all sectors except hotel up slightly

- Industrial still top performer although off historic highs

- Rent and NOI growth holding up so far, but

- Keep an eye on expenses – especially insurance

- Cap rates level off but haven’t increased so far with the rising cost of debt

Click the link to access Dr. Fisher’s presentation deck or session recording.